Inclusive of contributions, total assets of the territory’s Mandatory Provident Fund ( MPF ) retirement scheme will end July at an all-time record high of around HK$1.45 trillion ( US$184.71 billion ) – up HK$20.3 billion from June, and up HK$158.6 billion for year-to-date), and equivalent to an average MPF account balance of HK$302,400 ( up HK$4,200 from June, and up HK$33,100 for year-to-date ), according to a recent report.

In absolute dollar terms, July’s investment gain was the equivalent to HK$16.8 billion ( or HK$3,500 per the MPF scheme’s 4.79 million members ) to take year-to-date gains to HK$132.2 billion ( or HK$27,600 per member ), finds the report by MPF Ratings ( MPFR ), an independent research provider in Hong Kong.

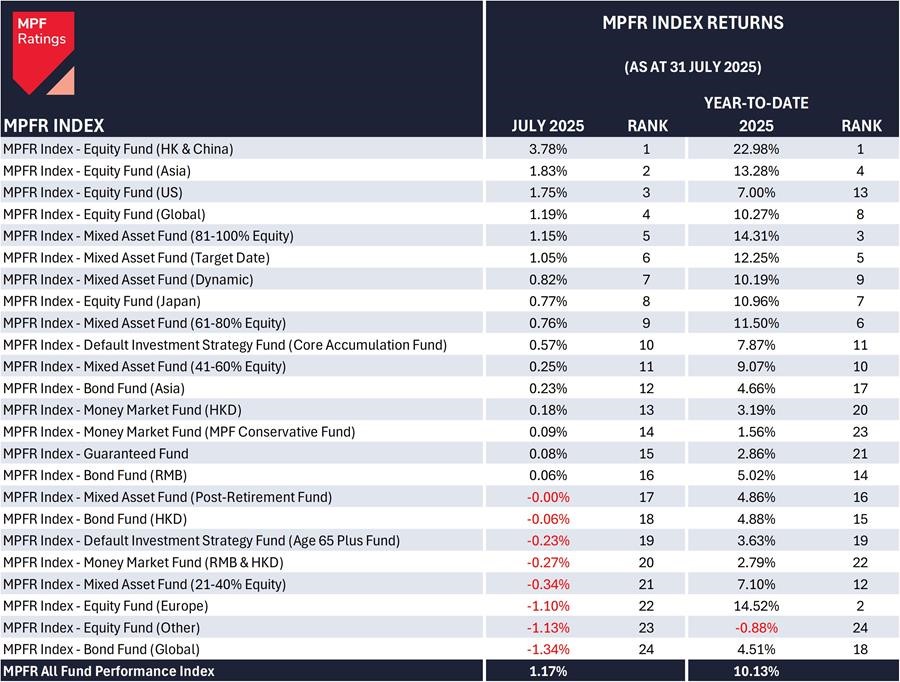

MPF Ratings’ MPFR All Fund Performance Index is up 1.17% for July and 10.13% year to date. The system has now recorded five positive return months out of seven in 2025.

MPFR Index returns by asset class ( as at July 31 2025 )

“The MPF’s record size and average account balance is clearly good news for MPF members, and a timely reminder that disciplined investing is crucial,” says Francis Chung, MPFR’s chair. “Diversification and long-term investing are the keys to long-term wealth creation.”