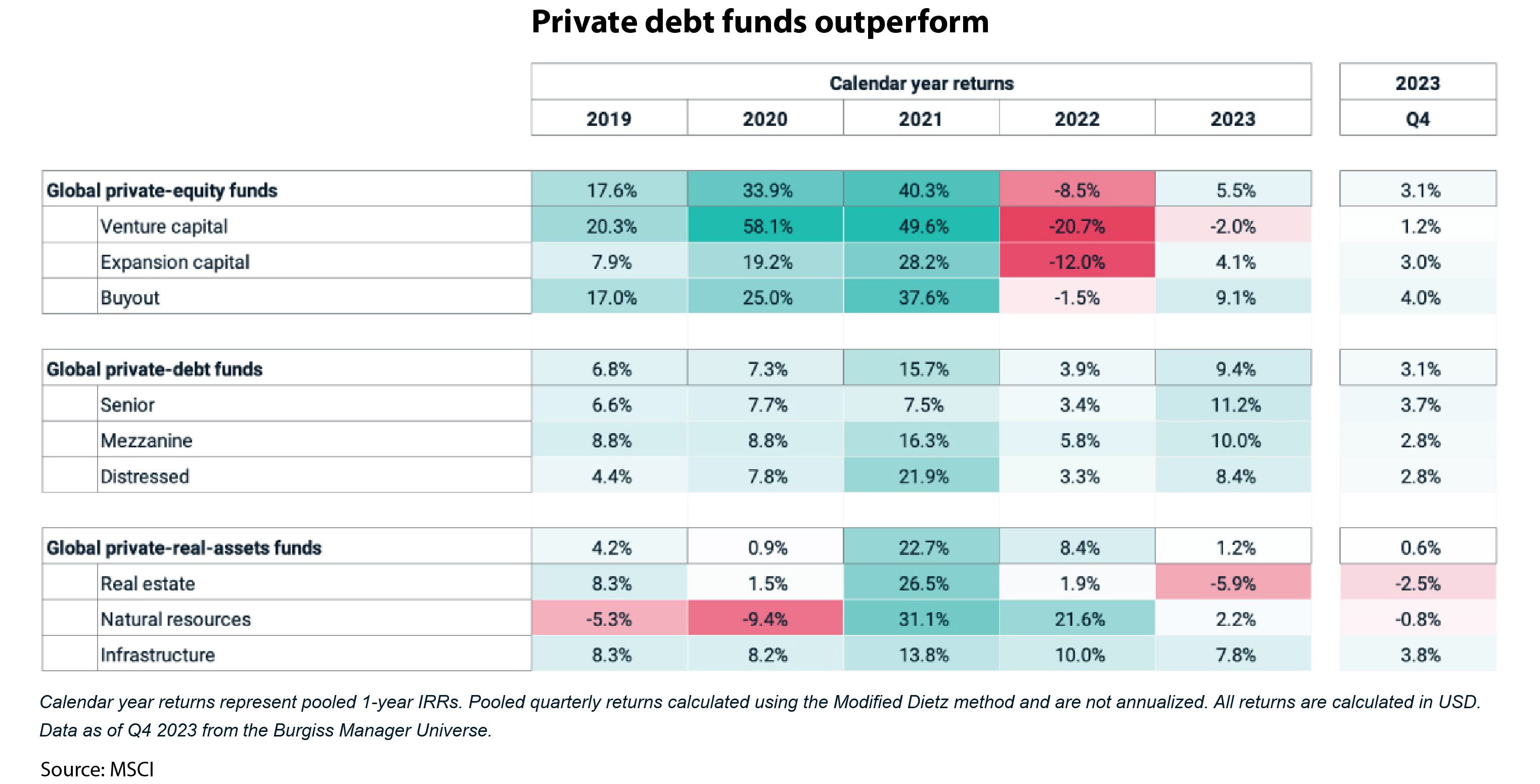

Senior debt funds registered the highest annual return among major private asset classes in 2023, with mezzanine debt funds posting the second highest return, according to MSCI.

In private equity, buyout funds outperformed venture capital, which posted a negative return, Keith Crouch, head of private capital index research and product development at MSCI, says in a research note.

Private real assets funds showed mixed results, with infrastructure and natural resources showing positive returns, while real estate was down, Crouch says, based on the Q4 2023 update of Burgiss Manager Universe data.

Venture capital, meanwhile, reversed a seven-quarter streak of declines, posting a 1.2% return in Q4 2023. Venture capital funds had dramatically outperformed all other asset classes in 2020 and 2021 but have since underperformed, with a cumulative return for the 16 quarters since 2019 now about tied with buyout funds.

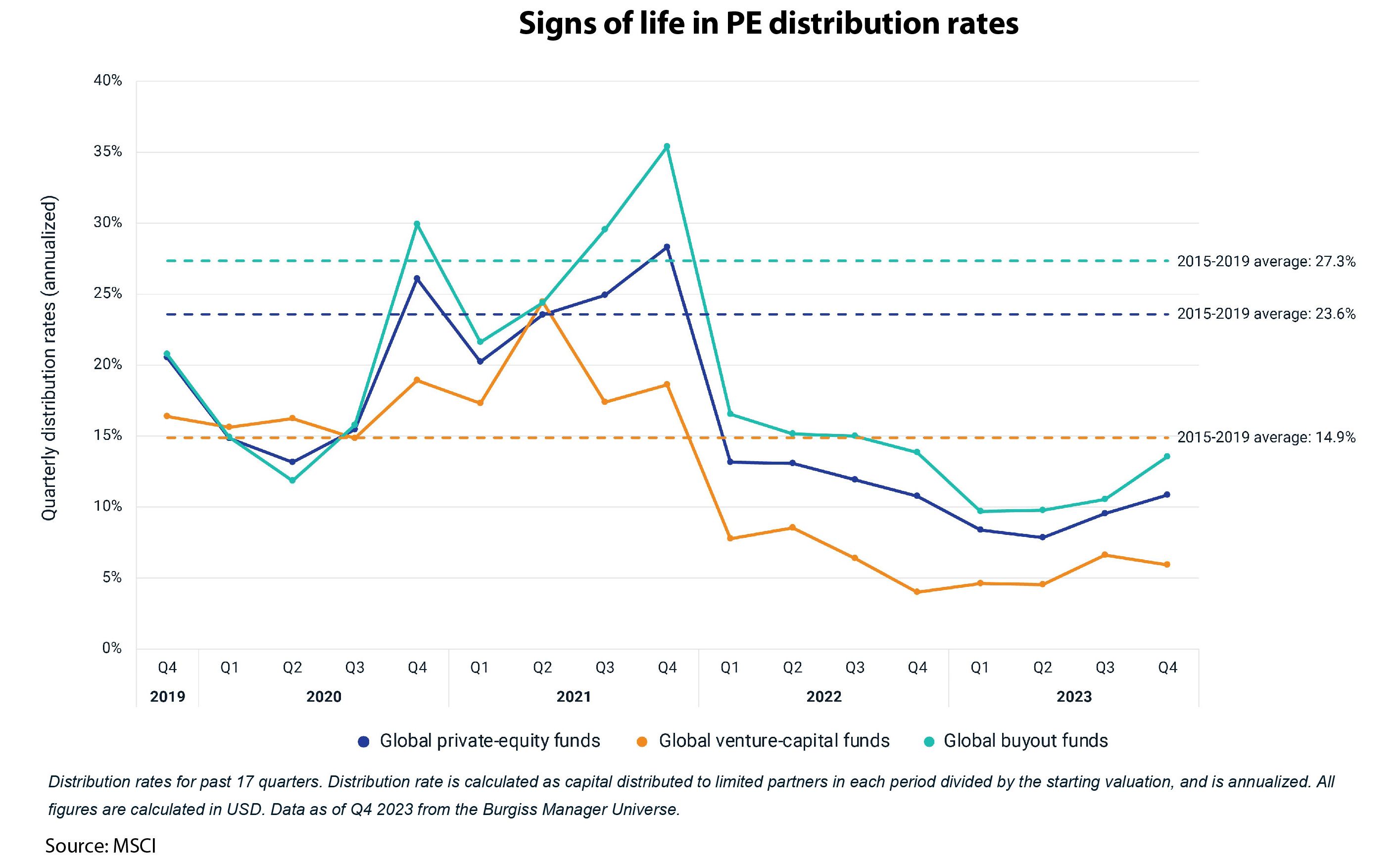

The slow pace of distributions remains a concern for limited partners in private equity funds, Crouch notes. Newly raised funds continued to call capital while distributions from mature funds have been muted since 2022.

Private equity funds did post the highest quarterly distribution rate for the year in Q4 ( 10.8% annualized ), but the full-year 2023 distribution rate of 9.5% was well below the 2015-19 average of 23.6% and even below the 11.8% rate in 2022.

The Burgiss Manager Universe covers over 13,000 private asset funds around the world, representing US$15 trillion in cumulative investments across private equity, private real estate, private debt, infrastructure, and natural resources in 195 countries.